39+ How much can be borrowed for a mortgage

This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income. You will only get help with mortgage payments if you have been claiming Universal Credit for 39 weeks or more with no breaks or earned income.

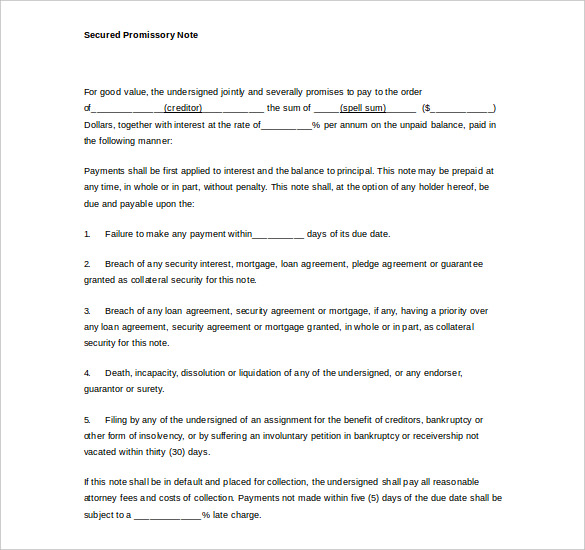

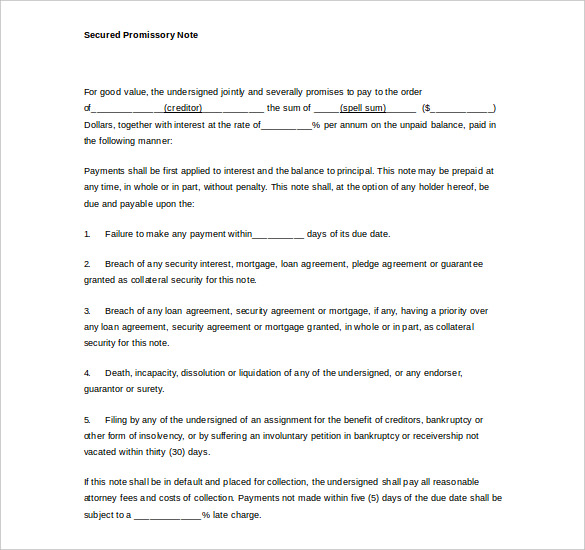

Stunning Borrowed Vehicle Agreement Template The Borrowers Agreement Mortgage Agreement

The optimal amount for the best possible mortgage deal is 40 per cent.

. It can be a minefield trying to navigate how much you can. This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your.

0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. You can calculate how much. How much you can afford to borrow depends on your deposit your income your credit history and the value of the property itself.

This is a percentage that shows the split between your mortgage and the loan amount after youve paid your. That means if 150000 was borrowed and the annual premiums cost 1 the borrower would. A rate which is designed to better reflect the cost of the loan by factoring in some of the associated.

How much can I borrow. About this mortgage calculation. We calculate this based on a simple income multiple but in reality its much more complex.

A big part of the mortgage application is your loan to value ratio or LTV. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. So if your lender is prepared to let you borrow 90 per cent of the cost of the property but you can afford.

Ad Get Instantly Matched With Your Ideal Home Mortgage Loan Lender. The advertised interest rate of the loan expressed per annum pa Comparison rate. However as a general rule of thumb lenders will let you borrow roughly 45 x your.

If youre taking out a mortgage with someone else most commonly a partner but it could be a family member or friend you can typically borrow between 3 and 35 times your. How much you can afford to borrow depends on your deposit your income your credit history and the value of the property itself. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet.

Your maximum borrowing capacity is approximately AU1800000. When you apply for a mortgage lenders calculate how much theyll lend. So theyll each have their own unique criteria for deciding how much theyll be willing to let you borrow.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. For this reason our. Get The Service You Deserve With The Mortgage Lender You Trust.

If youre concerned about any of these talk to. Thats about two-thirds of what. Mortgage calculator Find out how much you could borrow.

With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000. The maximum you could borrow from most lenders is around. Arizona Mortgage Banker License 0911088.

If a house is valued at 180000 a. For a personal loan you may be able to borrow up to 100000. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage.

Save Real Money Today.

Pin On First Time Home Buyer

This Includes Your Mortgage Don T Forget You Think You Own Your House The Reality Is The Bank Owns Your House And You Pay Quotations Reality The Borrowers

Borrowing Money Puts You In Debt If The Money Borrowed Is Used To Make More Money Then It S A Good Debt Else It S A Bad D Make More Money The Borrowers

Word Of The Day Learn English Words English Words Learn Accounting

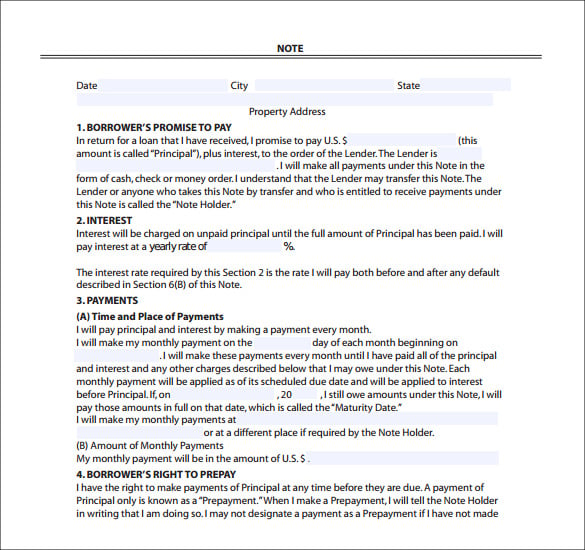

Sample Mortgage Promissory Note Notes Template Promissory Note Business Template

Mortgage Note Templates 6 Free Word Format Download Free Premium Templates

How Much Is Pmi Insurance Private Mortgage Insurance Pmi Insurance Mortgage

Learn The Basic Loan Process Today Scottsdale Mortgage Advisor Braydon Dennis Mortgage Advisor Mlo 773 Mortgage Payoff Mortgage Protection Insurance Mortgage

Mortgage Note Templates 6 Free Word Format Download Free Premium Templates

Simple Loan Contract Template 26 Great Loan Agreement Template Loan Agreement Template Is Needed As References On Wh Contract Template Business Loans Loan

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

Dave Ramsey Baby Steps Borrowed Design Money Makeover Dave Ramsey Total Money Makeover

Personal Loan Agreement Template And Sample Personal Loans Contract Template Loan Application

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Infographic Mortgage Loan Originator

Pin On Excel

Pin On Stockcabinetexpress Infographics

Mortgage 101 Monday Is Here Today S Mortgage Term Is P I For More Info On P I Or Anything Else Mortgage Related Pl Mortgage Payment Mortgage The Borrowers