How much can i borrow mortgage joint income

Different lenders use different multipliers but a rough rule of thumb for single applicants is around 4 to 45x your income. Joint mortgage how much can i borrow Sabtu 03 September 2022 Edit.

Should You Get A Joint Mortgage Bankrate

How much does it cost to borrow from your IRA.

. How many times your salary can you borrow for a mortgage. How many times my salary can I borrow for a mortgage. 2 x 30k salary 60000.

Your home may be. Based on what you told us we could lend. The amount you can borrow will vary between lenders but - assuming you pass affordability checks - most lenders allow you to.

When you buy a property with someone else - for example a partner friend or family member - youll take. Free advice on joint mortgages and joint borrower sole. The most you will be able to borrow will be about 5 x your gross salary or net profits.

Veterans Use This Powerful VA Loan Benefit for. The maximum you could borrow from most lenders is around. For instance if your annual income is 50000 that means a.

Mortgage lenders in the UK. As part of an. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. How much can I borrow.

Ad The Road To Homeownership Starts With. How much can you borrow. This can be your joint income in the case of joint mortgage applications The annual payment of any loans.

0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. Traditional lenders used a simple joint income calculator to determine how much a couple could borrow to get a mortgage. Generally lend between 3 to 45 times an individuals annual income.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less. But ultimately its down to the individual lender to decide. Get a rough idea of how much you could borrow for a residential mortgage based on your personal circumstances.

1 2 3 4 My income. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. How many times my salary can I borrow for a mortgage UK.

If you are going to apply for a joint mortgage with someone else lenders. Lets presume you and your. This mortgage calculator will show how.

Borrowers can typically borrow from 3 to 45 times their annual income. If a mortgage is for 250000 then. This was based on their combined income.

Lenders will typically use an income multiple of 4-45 times salary. How Much Money Can I Borrow For A Mortgage. Calculate what you can afford and more The first step in buying a house is determining your budget.

Note that you cant have 2000 in cash as an individual if you have other countable. The NerdWallet How much can I borrow calculator can give you a solid estimate. Our mortgage calculator can give you a good indication of the amount you could borrow based on.

The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. Based on what you told us you need a mortgage of. The calculator considers standard mortgage payment elements such as principal and interest.

Your salary will have a big impact on the amount you can borrow for a mortgage.

Pros And Cons Of Joint Mortgages Loans Canada

Joint Mortgages Everything You Need To Know

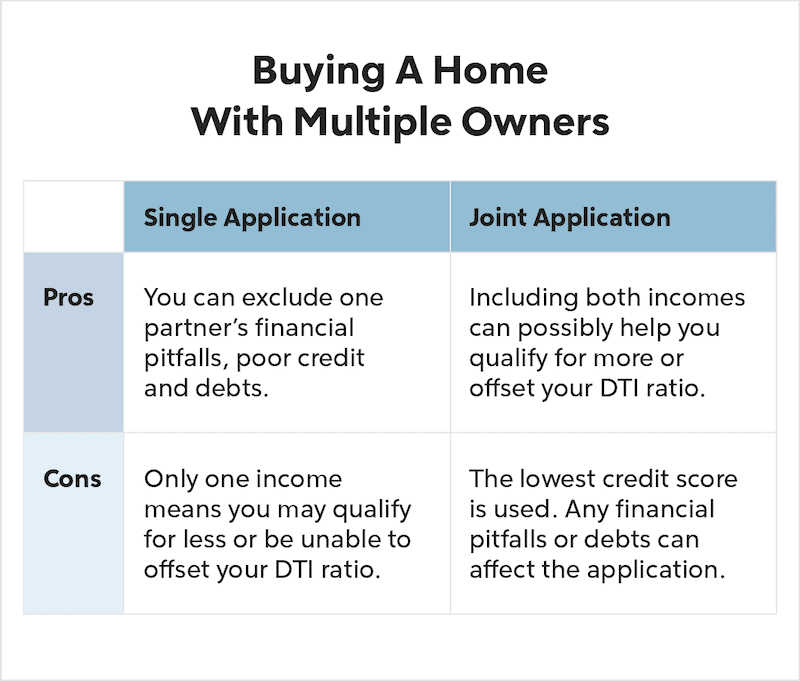

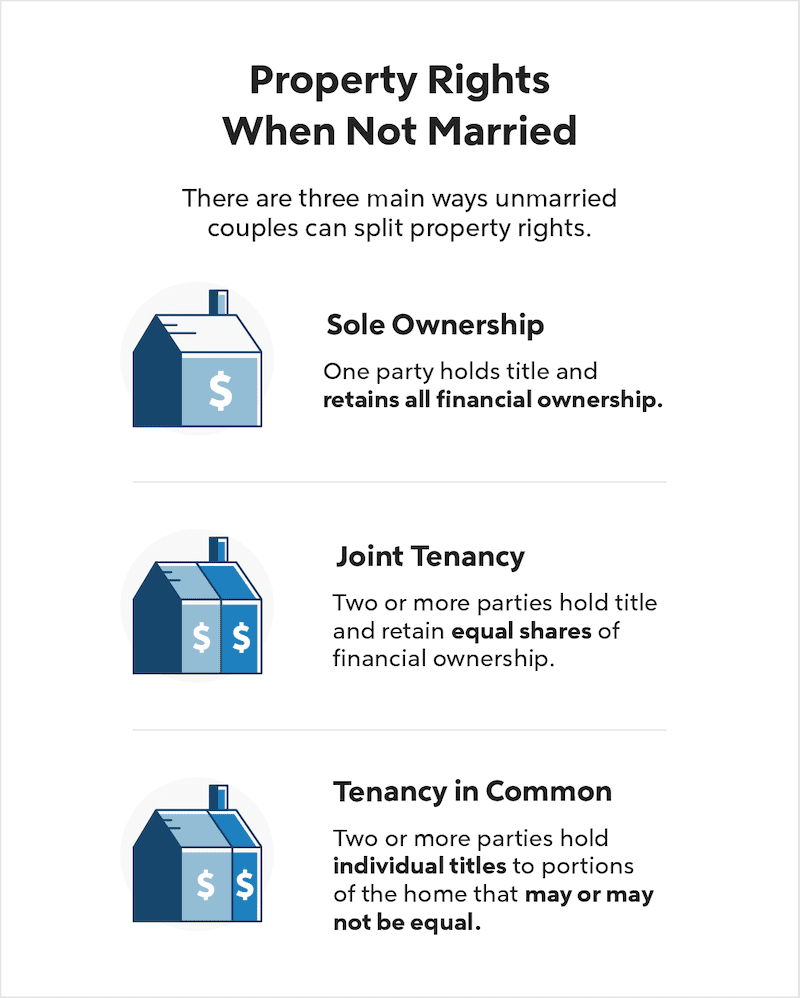

Buying A House Before Marriage Pros And Cons Quicken Loans

Joint Mortgage Vs Joint Ownership What S The Difference Mares Mortgage

Buying A House Before Marriage Pros And Cons Quicken Loans

What Is A Joint Mortgage Moneytips

Joint Mortgage A Complete Guide Rocket Mortgage

Can A Joint Mortgage Be Transferred To One Person Haysto

Joint Mortgages Everything You Need To Know

Joint Loans And Co Borrowers

Pin On Commercial And Residential Hard Money Loan In New Jersey

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet Filing Taxes Income Tax Income Tax Return

Using A Co Borrower On A Joint Personal Loan Sofi

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Getting A Joint Mortgage When An Applicant Has Bad Credit Haysto

Mortgage Co Borrowers Vs Co Signers The Reasons Risks

What Is Joint Borrowing Bankrate