40+ can you get a mortgage with collections

Ad 5 Best House Loan Lenders Compared Reviewed. Web Also paying off collections typically stops your score from dropping long-term but doesnt usually raise your score.

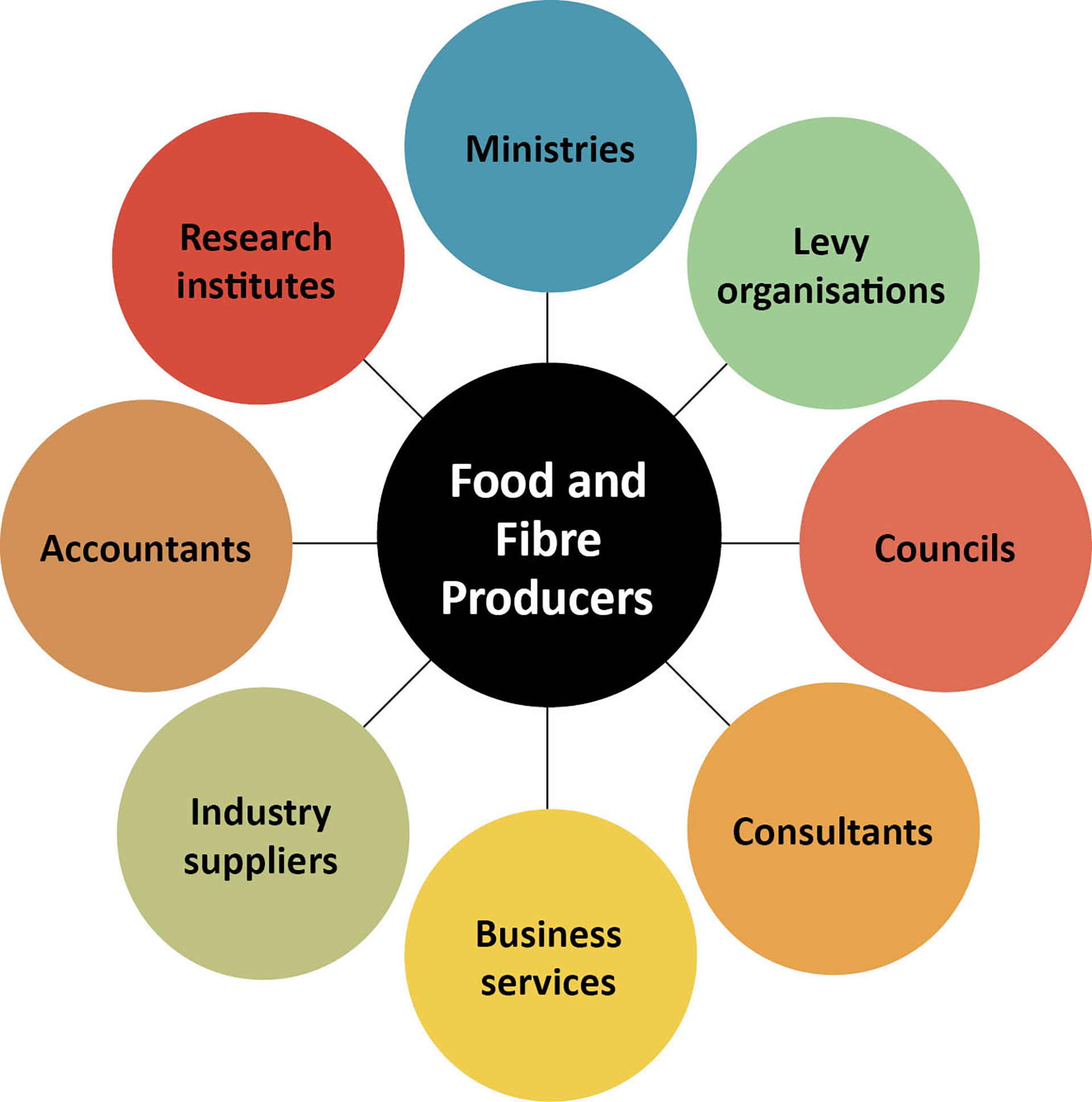

Frontiers Shifting Knowledge Practices For Sustainable Land Use Insights From Producers Of Aotearoa New Zealand

Once Youre Ready Close Confidently With Our 5K Closing Guarantee.

. Best Mortgage Lenders in Vermont. Save Real Money Today. Comparisons Trusted by 55000000.

Ad Down Payment Options As Low As 3 - Get One Step Closer To Home Today. HUD the parent of FHA does not require borrowers to pay off outstanding. Web So again yes pay your collections.

That is likely to torpedo your chances of qualifying for a home loan. Experts continue to encourage buyers to save a down payment of at least 20 before applying for a mortgage. Youll pay more without a minimum 20 down payment.

Start showing the lenders that although you made mistakes in the past you are now repaying your debts and becoming a. Apply Get Pre-Qualified in 3 Minutes. Web Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent even if the account has been paid in full.

Web You can qualify for an FHA loan with collection accounts based on HUD guidelines. Ad 5 Best House Loan Lenders Compared Reviewed. Apply Get Pre-Qualified in 3 Minutes.

Web Personal loans let you spread out a large expense over time and they might be a good option if you cant get a medical collector to agree to a payment plan. Comparisons Trusted by 55000000. Instead keeping balances below 30 of their maximum will help.

Here are some things you should know if you have. But you may want. Web In a Nutshell.

Web Yes but the collector must first sue you to get a court order called a garnishment that says it can take money from your paycheck to pay your debts. If you have debts in collection that usually means a third party is trying to retrieve payment for your debts on your creditors behalf. New England Federal Credit Union Offers Home Mortgage Loans For Your Financial Needs.

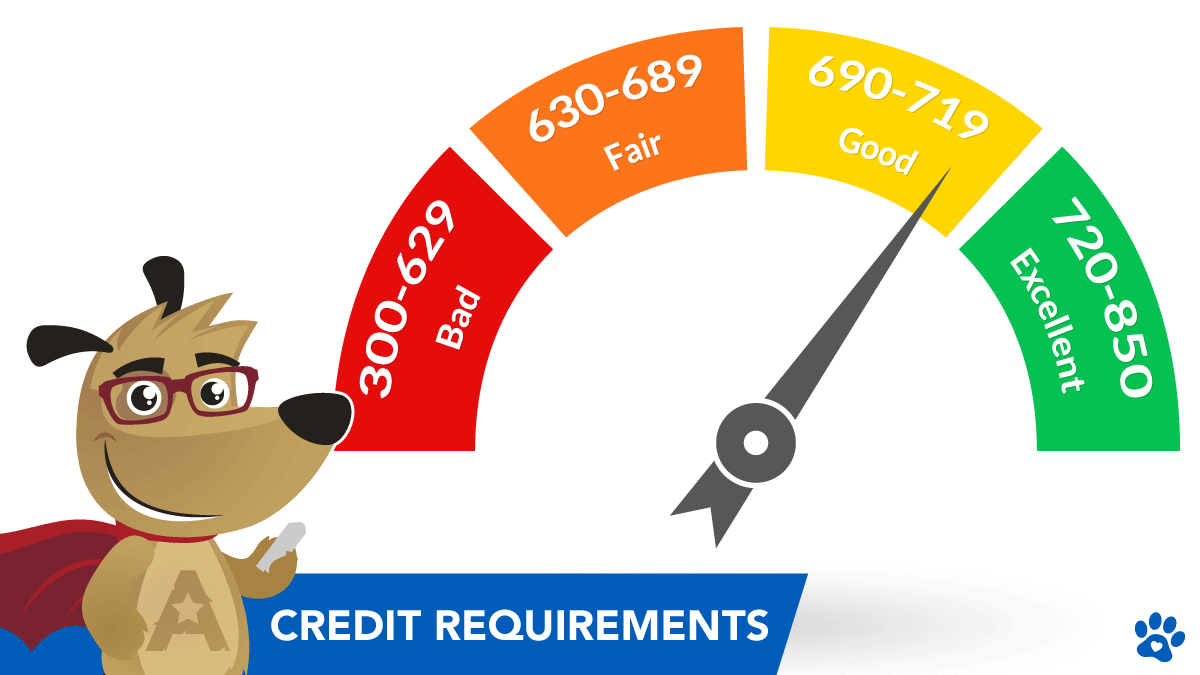

Best Mortgage Lenders in Vermont. Most lenders will require a 640 credit score to qualify for the. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

Web Fortunately the answer is yes. Debt collection is a. Web If you have a 20000 balance for instance FHA lenders add 1000 to your monthly debt service.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Ad NEFCU Is The Smart Choice When It Comes To Your Mortgage Financing. Web A loan from the USDA allows you to buy a home in a qualifying rural area with a 0 down payment. Ad Contact our local mortgage team with your questions today.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. But it depends how much money you owe and what type of debt it is.

Credit Requirements For A Reverse Mortgage In 2023

Can Collection Activity Hurt Your Fha Loan Chances

10 Important Things To Do When You Open A New Credit Card

Scripts To 40 Loan Documents For Loan Signing Agents Notary Etsy

Mortgage With Collection Accounts And Charge Offs

Top 100 Fintech Startups Making A Breakthrough In 2021

5 Tips For Easier Mortgage Financing Through A Usda Home Loan

Boston Plan At Urban Collection At Palmer Village In Colorado Springs Co By Richmond American Homes

Mortgage Questions Should I Pay Off My Collections

The Bluebell Meadowlark The Flora Collection Parker Co Trulia

Tpo Non Agency Products Credit Reporting Qc Home Insurance Fee Collection Tools Mortgage Apps Skyrocket

Don T Reactivate A Collection Account When Applying For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Superhome Sl Looking Glass The Grand Collection Parker Co Trulia

Stamps Auction Catalogue All World 2008 By David Feldman Issuu

Don T Reactivate A Collection Account When Applying For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Currentcy

Should You Pay Off Collections Before Applying For A Mortgage